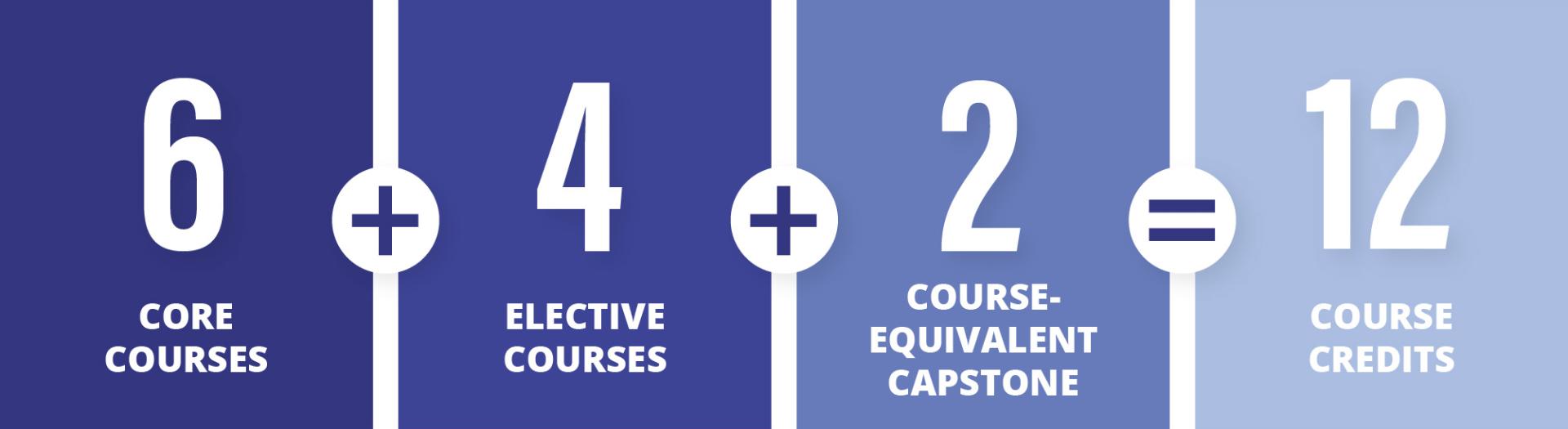

Curriculum Structure of Master of Family Wealth Management*

Core Courses (Six Courses)

Know more

- History of Wealth and Financial Markets

- History of the Family and Family Business Dynasties

- Asset Allocation and Investment Management

- Corporate Finance and Business Models

- Estate Planning and Legal Issues

- Current Issues in Family Office Management

Elective Courses** (Four Courses^)

Know more

- Economic and Quantitative History

- Business History and Best Practices

- Faith, Religion and Leadership

- Psychology, Group Dynamics and Management

- Cross-cultural Communication and Management

- Introduction to Economics and Finance

- Hedge Funds, Private Equity Funds and Other Alternative Investments

- Emerging Markets and Global Investment Opportunities

- Philanthropy and Social Impact Investing: Integrating CSR and ESG into Family Wealth Management

Capstone Course (One Course)

Know more

- Family Wealth Management Capstone Project

*The curriculum structure is subject to review and adjustments by the University.

**Not all of the elective courses listed above will necessarily be offered each year, and the above list is subject to further adjustments.

^MFWM students may take up to two elective courses outside the MFWM programme:

- A maximum of two 6-credit electives from the taught postgraduate curricula offered by the Faculty of Business and Economics may be allowed under the advice and approval of the Programme Directors concerned.

- Alternatively, MFWM students may take one of the two outside electives from the Master of Social Sciences in the field of Nonprofit Management. The selection of cross-listed courses shall be subject to the approval of the Programme Director/Chair of the two respective programmes.

25th Jul,2025 Friday

25th Jul,2025 Friday 12:00 noon (GMT +8)

12:00 noon (GMT +8)